Latest Private Rented Sector Update

Catherine Alexander

Partner and Mortgage & Protection Adviser at GDA

The private rented sector is a vital part of the UK housing market, giving many people an accessible and affordable place to call home. It also plays an important role in driving economic growth by helping people move more easily for work. With the Government aiming to boost the economy and deliver 1.5 million new homes before the next general election, it’s important to keep the private rented sector working well.

Landlords’ investments are a big part of what keeps the housing market moving. Alongside more first-time buyers and more social housing, this encourages house builders to increase supply to meet demand. Without a healthy and thriving private rented sector, the Government could find it much harder to achieve its housing and growth goals.

Over recent years landlords have had to face significant market, taxation and regulatory changes which have combined to make operating a property rental business more complicated and less profitable. This has included changes in the ability to offset borrowing costs against income for tax purposes, the measures in the Renters’ Rights Bill and rapid increases in interest rates. While some of these changes are welcome, the combination of legislative change, tax increases and uncertainty over the future has caused many landlords to leave the market.

Research carried out based on data collected between March and April 2025 show how landlords currently feel about the changes to the market.

Looking in particular at the Minimum Energy Efficiency Standards reforms, although they have been on the agenda for some time, landlords feel in the dark with the detail, however, despite this, once landlords understand requirements, most aim to meet them for some or all properties by the deadline.

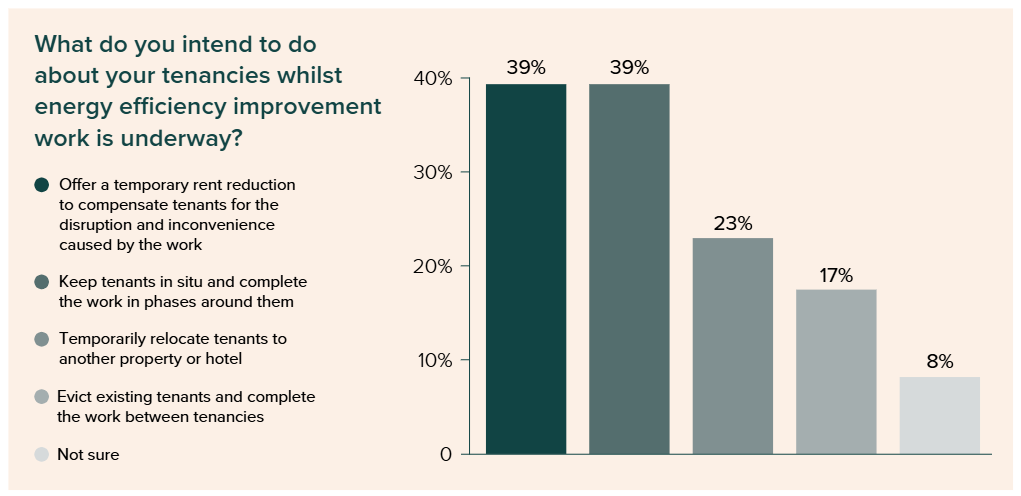

A large number of landlords are planning to wait before initiating any works on their properties. 54% say that they will wait for Government consultations to conclude or for the outcomes to be passed into law, significantly increasing the number of properties with an EPC rating of D or below. This is exacerbated by the fact that tenants will be disrupted by any energy efficiency improvements. 39% landlords are of landlords are mindful of the impact that energy efficiency improvements will have on their tenants, highlighting they plan to offer a temporary rent reduction as compensation for any disruption or inconvenience. This is matched by landlords who wish to navigate property upgrades in phases around tenants. A small proportion of landlords (17%) will need to evict tenants to complete the works, where the works will be so intrusive it would be unsafe for tenants to remain - in these cases the landlord still has the right to evict tenants under Section 21.

Although there are plenty of changes happening in the rental market, it can still be worthwhile to be a landlord in 2025, but it's crucial to be aware of the challenges and potential risks involved and how they can impact profitability.

The research in this report was conducted by Censuswide, among a sample of 1,000 landlords (aged 18+) with private rental property, based in either England or Wales. The data was collected between 26.03.25 - 08.04.25. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct and ESOMAR principles. Censuswide is also a member of the British Polling Council.

References

The Mortgage Works Private Rented Sector Report - Summer 2025. 2025. https://www.themortgageworks.co.uk/.

This article is for general information and does not constitute personal financial advice. If you’re unsure what’s best for you, seek independent financial advice.