Income Protection Action Week: 22nd - 26th September 2025

Next week, the Income Protection Task Force (IPTF) is hosting its annual Income Protection Action Week (IPAW) - a nationwide initiative designed to raise awareness about the importance of income protection and empower advisers to have more meaningful conversations with clients about safeguarding their financial wellbeing.

At GDA Financial Partners, we’re proud to support this vital campaign. As advisers, we see first-hand how illness or injury can disrupt lives - not just physically and emotionally, but financially. IPAW is a timely reminder that your ability to earn is your most valuable asset, and protecting it should be central to any financial plan.

Despite its importance, income protection remains one of the most underutilised forms of insurance in the UK. Many clients assume they’ll be covered by savings, employer sick pay, or critical illness policies - but these can often fall short when illness or injury strikes.

Consider that:

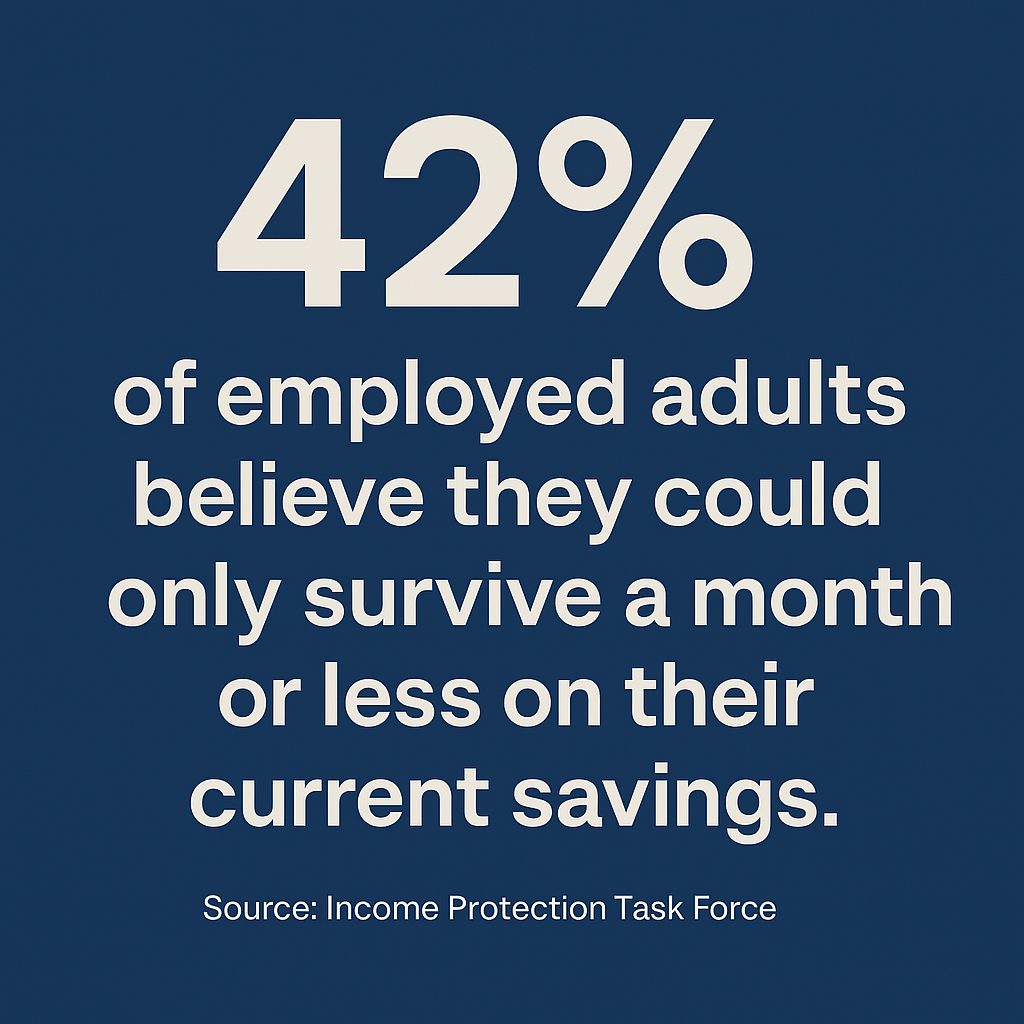

42% of employed adults believe they could only survive a month or less on their current savings.

Statutory Sick Pay is just £109.40 per week - hardly enough to cover rent, bills, and essentials.

Critical illness cover pays out only for specific conditions and often just once.

Income protection, on the other hand, provides regular, tax-free payments until you’re well enough to return to work - or until retirement. It’s flexible, reliable, and tailored to your needs.

If you’ve never considered income protection—or if it’s been a while since you reviewed your cover - now is the perfect time. Whether you're employed, self-employed, or running a business, protecting your income is one of the smartest financial decisions you can make.

Why not speak to one of of our advisers today, and let’s make sure you and your family are financially resilient, no matter what life throws your way.

References

2025. IPAW 2025. https://iptf.co.uk/ipaw-2025/

This article is for general information and does not constitute personal financial advice. If you’re unsure what’s best for you, seek independent financial advice.